what is a quarterly tax provision

A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year. Simplify your ASC 740 process with Bloomberg Tax Provision a corporate tax provision software.

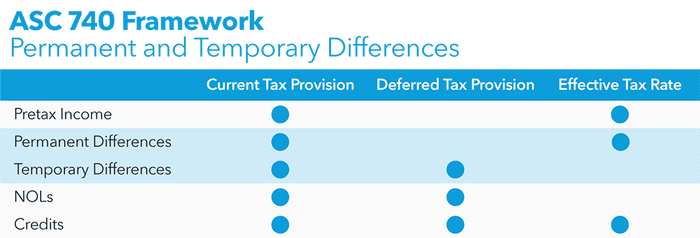

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Tax rate changes in the quarter in which the law is effective.

. A tax provision is just one type of provision that corporate finance departments set aside to cover a probable future expense. Making your payments every quarter is an exercise in estimation. This issue discusses several important developments and related ASC 740 considerations.

The provision is always calculated on a year-to-date basis no matter how frequently it is calculated. An Administrator or Power User can also create interim tax periods for example monthly or non-year end to estimate the current and deferred taxes for the interim period based on the Annualized Estimated Effective Tax Rate AEETR. Quarterly Hot Topics is now available.

Topics covered in this edition. After calculation the system automatically translates the tax data from the local currency to the reporting currency for the consolidated reports. Tax rate changes in the quarter in which the law is effective.

16343 Interim provisionincome from equity method investments. These quarterly payments must be post-marked by April 15th of the current year June 15th September 15th and January 15th. You can figure your quarterly payments by using Form 1040-ES.

At each interim period a company is required to estimate its forecasted full-year effective tax rate. Simply put a tax provision is the estimated amount of income tax that a company is legally expected to pay to the IRS for the current year. Lets take a step back here and recap what the annual tax provision is itself as well as the quarterly.

You can figure your quarterly payments by using Form 1040-ES. The provision can be calculated on a monthly quarterly or annual basis as required. 162 Basic method of computing an interim tax provision.

The deferred tax calculation which focuses on the effects of temporary differences and other tax attributes over. This includes your federal income taxes your payroll taxes Social Security and Medicare your state income taxes and if incorporated your state and federal unemployment insurance payments. If you want to break that down Howard.

Annual ETR applied to YTD income plus discreet tax items make up the quarterly annual tax expense. The amount of this provision is derived by adjusting the firms reported net income with a variety of permanent differences and temporary differences. If you owe too much you might actually be penalized too.

A tax provision is comprised of two parts. A tax rate is generated at the beginning of the year for summary periods such as Quarterly or Yearly. You do quarterly reviews less substantial in scope than an audit.

A companys current tax expense is based upon current earnings and the current years permanent and temporary differences. Calculate the quarterly tax provision c. Assume no discrete items and the following quarterly information.

The corporate income tax provision is an important and complex component of the financial statements and related disclosures and it is receiving ever-increasing scrutiny due to its significance to the operating statement. It is typically appropriate to record an investors equity in the net income of a 50 or-less owned investee on an after-tax basis ie the investee would provide taxes in its financial statements based on its own estimated annual ETR calculation. Calculate the quarter effective tax rate Q1 Q2 Q3 Q4 Projected full-year AETR 40 35 37 35 Quarterly book income 400 100 200 700.

The entry to income tax expense will be a debit because you are increasing the expense account. Negative ETR due to withholding taxes orand naked credit tax effects Jurisdictions for which a reliable estimate cannot be made Exception Two Recognize a tax expense benefit for the year -to-date ordinary income loss as if a tax return were filed on the year-to-date income loss discrete calculation. The IRS expects you to pay at least 90 of what you owe throughout the year.

Typically this is represented quarterly with each earnings. Level 2 4 yr. That rate is applied to year-to-date ordinary income or loss in order to compute the year-to-date.

Of course now forms 10-K and 10-Q are annual and quarterly reports that tell us about who a company is and how theyve been doing and part of the reports is the provision for income tax. Calculate the year-to-date tax provision b. Therefore although you may pay taxes annually or quarterly you should do an adjusting entry during each period for which you produce an income statement.

Us Income taxes guide 162. The provision is the audit part of tax. Yes Im studying AUD right now the company estimates their taxable income for the year and every quarter you adjust the provision to correct what was.

In recent years tax-related issues have been a primary reason for restating financial statements and accounting for. RTP is return to provision. Thats why theyre called quarterly estimated tax payments.

The provision for income taxes on an income statement is the amount of income taxes a company estimates it will pay in a given year. I would say provision is a lot more complex and challenging at the MNC F500 level. Efficiently and accurately address the entire range of complex ASC 740 technical topics including Uncertain Tax Benefits UTBs ARB 51 Quarterly Annual Effective Tax Rate AETR calculations robust state computations and Income Tax.

Tax provision is just calculating the estimated tax owed by a businessindividual for the current year. It includes a worksheet that helps you figure. Interim Tax Provisioning Overview.

And if you care about learning planning understanding how it gets reported and. Tax provision is just calculating the estimated tax owed by a businessindividual for the current year. For permanent items to the extent the amount estimated at provision is different than the tax return amounts you need to true up the ETR for the difference.

Temporary items RTP dont go through the ETR unless there is a statutory rate change snd they are balance sheet adjustments only between deferred and. The latest issue of Accounting for Income Taxes. Treating an item as discrete concentrates the tax effect in the quarter recognized while treating the item in the forecast annual ETR smoothes the tax impact over the full year.

Other types of provisions a business typically accounts for include bad debts depreciation product. Provision for Income Tax. The adjusted net income figure is then multiplied by the applicable.

You do this a lot for financial statement purposes. Current income tax expense and deferred income tax expense. Recent editions appear below.

Prepared By Lilybeth A Ganer Revenue Officer Ppt Download

Tcs Under Income Tax Provisions Applicable From 01 10 2020

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

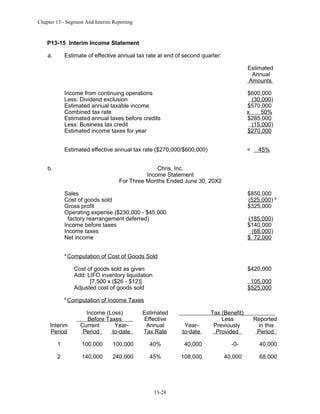

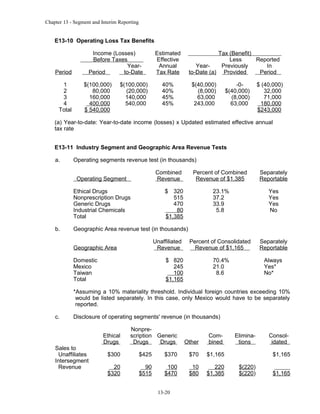

Solusi Manual Advanced Acc Zy Chap013

Solusi Manual Advanced Acc Zy Chap013

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Tcs Under Income Tax Provisions Applicable From 01 10 2020

Resume Tax Manager Tax Manager Resume Becoming A Tax Manager Is A Vital Job To Applying For That You Must Build An Exce Manager Resume Resume Resume Tips

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Solusi Manual Advanced Acc Zy Chap013

Provision For Income Tax Definition Formula Calculation Examples

Bloomberg Tax Bloombergtax Twitter

Provision For Income Tax Definition Formula Calculation Examples